RERA Regulations: Complete Guide to Off-Plan Property Protection in Dubai (2025)

Understanding Dubai’s Revolutionary Off-Plan Property Protection System

Investing in off-plan properties in Dubai has become increasingly attractive for both local and international investors.

However, understanding the regulatory safeguards that protect your investment is crucial before committing significant capital.

Dubai’s Real Estate Regulatory Agency (RERA) has established one of the world’s most comprehensive buyer protection frameworks for under-construction properties.

This guide examines the complete legal structure governing off-plan investments in Dubai, explaining how RERA regulations, escrow account protections, and specialized tribunals work together to safeguard your investment from developer misconduct and project failures.

Find Out: AL Furjan Off Plan Property for Sale

What is RERA and Why Does It Matter?

The Real Estate Regulatory Agency operates under the Dubai Land Department (DLD) as the primary enforcement body for real estate market compliance.

While the DLD maintains property registration and title deed records, RERA oversees day-to-day market operations, including licensing real estate practitioners, monitoring construction progress, and supervising developer conduct.

This bifurcated structure creates a powerful protection mechanism: the DLD preserves the permanent legal record of ownership, while RERA can swiftly impose penalties, suspend sales, or revoke licenses for compliance violations without disrupting the foundational property registry.

The Three Legal Pillars of Buyer Protection

Dubai’s off-plan protection system rests on three interconnected legislative frameworks:

Law No. 8 of 2007 (Escrow Account Law) establishes mandatory project-specific escrow accounts that ring-fence buyer payments, preventing developers from diverting funds to other projects or operational expenses.

Law No. 19 of 2017 (Contract Cancellation Law) defines strict procedures for contract termination and caps the amount developers can retain if buyers default, providing predictable financial exposure limits.

Decree No. 33 of 2020 (Special Tribunal Decree) created a specialized judicial body to efficiently resolve disputes related to cancelled or stalled projects, streamlining the recovery process for affected investors.

Mandatory Pre-Sale Compliance Requirements

Before any developer can legally sell off-plan units in Dubai, they must satisfy rigorous regulatory requirements designed to verify project viability.

Developer Licensing and Project Registration

Every developer must hold valid RERA licensing before marketing off-plan properties. Beyond general licensing, each specific project requires independent registration with the DLD, including submission of construction permits, approved architectural designs, and realistic construction schedules.

For investors, this means verifying two critical elements: the developer’s active RERA license and the project’s specific approval number, known as the M-code. Any sale agreement executed before project approval and DLD registration is legally void, leaving investors without recourse.

Transparency and Disclosure Obligations

RERA mandates comprehensive disclosure of project details, including approved completion timelines, ownership structure (freehold versus leasehold), and complete payment schedules.

Developers must also ensure all marketing materials align with approved technical specifications to prevent disputes arising from discrepancies between advertised features and delivered properties.

The Escrow Account System: Your Primary Financial Shield

The cornerstone of Dubai’s buyer protection framework is the mandatory escrow account system established under Law No. 8 of 2007.

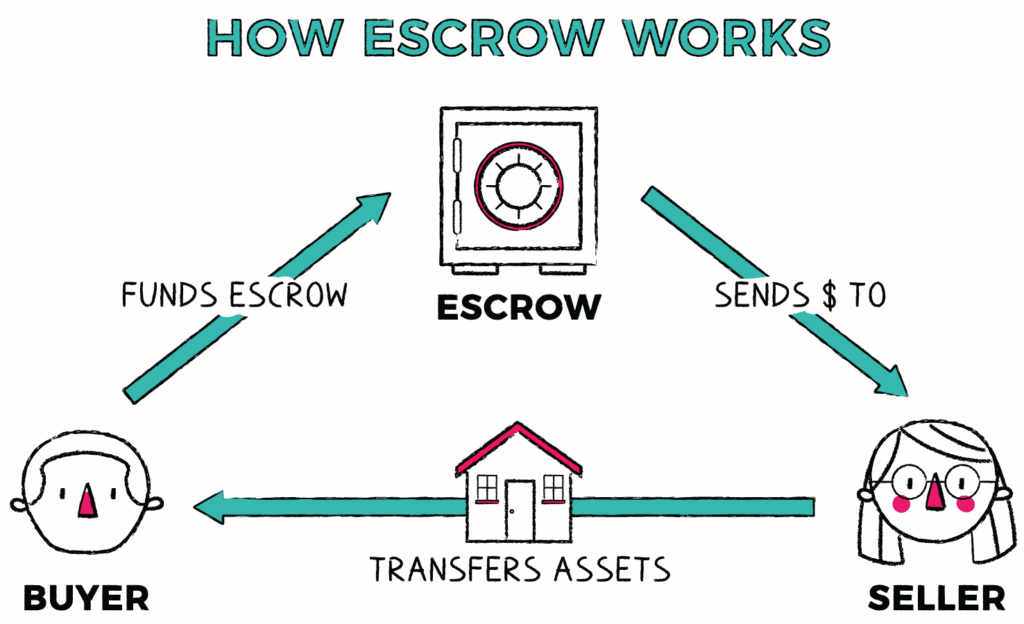

How the Escrow Mechanism Works

Every off-plan project must maintain a dedicated, project-specific escrow account with a DLD-approved bank.

This government-monitored account functions as a secure intermediary, holding buyer payments in trust and legally separating them from the developer’s operational finances.

All buyer payments according to the agreed schedule must flow directly into this designated escrow account.

This fundamental requirement ensures that your investment capital cannot be diverted to unrelated projects or business expenses.

Controlled Fund Release Based on Construction Progress

The escrow system’s protective power lies in its controlled disbursement rules.

Developers cannot access funds until they meet verified construction milestones certified by approved consultants and subsequently approved by the DLD.

A typical staged release schedule might include:

- 20% upon foundation completion

- 30% upon structural completion

- 30% upon internal finishes completion

- 20% upon final handover

This milestone-based approach synchronizes your financial commitment with physical project progress.

If construction halts or the project fails, unreleased funds remain protected in the escrow account, substantially limiting your potential capital loss.

Should a developer face bankruptcy, only funds already disbursed for verified completed work are at immediate risk.

The remaining balance stays protected for project restructuring or buyer refunds as mandated by RERA procedures.

Evolution of Pre-Sale Requirements

RERA previously required developers to achieve 20% physical completion or deposit an equivalent bank guarantee before launching sales.

While the application of this rule has evolved, the underlying principle remains: verifying developer financial capacity and commitment before exposing buyers to investment risk during the critical project launch phase.

Oqood Registration: Making Your Contract Legally Enforceable

For an off-plan purchase agreement to be legally enforceable in Dubai, it must be registered through the Oqood system, the Interim Property Register managed by the DLD.

The Registration Process

Following execution of the Sale and Purchase Agreement and payment of the initial deposit (typically 10-20% of the purchase price), the developer files the registration request via the Oqood portal, including payment of the mandatory 4% DLD registration fee.

Oqood registration provides official DLD recognition of your interest, documenting you as the legal owner of the under-construction unit.

This recognition serves multiple critical functions: it creates a verifiable ownership trail preventing developer misconduct, and it serves as a legal prerequisite for lawfully reselling or transferring the off-plan property.

Legal Risks of Non-Registration

Without Oqood registration, buyers lack official DLD recognition, fundamentally undermining the contract’s legal standing.

Dubai legal precedent confirms that unregistered off-plan units may be deemed null and void by courts, with typical remedies limited to fund repayment rather than sale enforcement.

For institutional investors, Oqood registration serves as the primary validation of legal enforceability.

Treat any purchase as high-risk until securing official registration confirmation, regardless of full payment plan adherence.

Your Rights When Developers Breach Contracts

RERA holds developers strictly accountable for adhering to contractual timelines and specifications, activating specific statutory compensation rights when breaches occur.

Standardized Compensation for Project Delays

Developers must comply with construction and delivery timelines approved during project registration.

Failure to meet these deadlines without valid reasons (such as qualifying force majeure events) can result in penalties or sales suspension.

If project delay exceeds six months beyond the contractually agreed completion date, buyers may be entitled to receive 1% of the property value per quarter in compensation.

This standardized approach moves damage assessment away from subjective litigation toward quantifiable statutory restitution.

Beyond statutory compensation, buyers can seek reimbursement for direct losses, including temporary accommodation costs or lost anticipated rental income.

Protection Against Specification Changes and Area Reductions

RERA regulations safeguard the physical asset you contracted to purchase. When discrepancies arise between promised and delivered properties (such as unauthorized material or finish changes), buyers can claim full compensation with interest for diminished value.

If the delivered unit area decreases compared to the Sale and Purchase Agreement, developers must compensate purchasers for that decrease unless deemed inconsequential.

Conversely, if the unit area increases, developers cannot claim additional payment.

Structural Defects Warranty

Developers remain responsible for repairing structural defects revealed within a predetermined period following property delivery, executing repairs at no cost to buyers.

This provision offers essential long-term protection against latent construction defects.

Understanding Termination Rights and Retention Limits

Law No. 19 of 2017 establishes a strict, tiered process governing developer recourse against defaulting buyers, protecting purchasers from arbitrary investment capital forfeiture.

The Required Termination Procedure

Developers cannot unilaterally terminate a Sale and Purchase Agreement immediately upon payment default. They must follow a defined regulatory sequence:

First, the developer must formally notify the DLD of the purchaser’s non-performance. Upon receiving and verifying this notification, the DLD issues a thirty-day notice to the purchaser (delivered in person, by registered mail, or electronically) allowing time to fulfill contractual obligations.

If the breach remains unresolved after this period, the developer’s subsequent action is strictly limited by verified construction completion percentage.

Statutory Retention Caps Based on Project Completion

The law establishes maximum retention amounts based on project completion stage, providing predictable loss exposure for investors:

If construction has not started: Developers can retain up to 30% of amounts already paid, refunding excess amounts within sixty days.

At less than 60% completion: Developers can retain up to 25% of the total unit value stipulated in the agreement.

Between 60% and 80% completion: Retention increases to up to 40% of total unit value.

When completed but not handed over: Retention remains capped at 40% of total unit value.

This tiered structure provides predictability, ensuring developers cannot claim complete forfeiture even in buyer default scenarios.

Protection When Projects Fail Completely

When developers fail to proceed with projects, leading to RERA-ordered cancellation, the statutory obligation is clear: developers must refund all payments made by purchasers. The escrow account serves as the guaranteed recovery mechanism, ensuring protected funds remain available for refund purposes.

Specialized Dispute Resolution Framework

Dubai has centralized complex off-plan dispute resolution through specialized mechanisms designed to expedite resolution and maximize recovery potential.

RERA’s Initial Resolution Role

RERA handles initial dispute resolution stages, focusing on mediation and compliance monitoring for contractual breaches and timeline issues. The DLD structure encourages initial mediation attempts through RERA before escalating to specialized judicial bodies.

The Special Tribunal for Failed Projects

Recognizing the complexity of liquidating failed projects while managing numerous buyer claims, Dubai established the Special Tribunal for Liquidation of Cancelled Real Property Projects through Decree No. 33 of 2020.

This specialized judicial body holds exclusive jurisdiction over all disputes arising from unfinished or cancelled real estate projects, overriding all other Dubai courts including DIFC Courts.

The Tribunal’s significant powers include:

- Reviewing and settling rights and obligations of all involved investors

- Issuing orders to escrow account trustees regarding fund disbursement

- Liquidating stalled projects or mandating transfer to financially competent developers

This centralized authority expedites capital recovery by enabling forced transfer of project assets and remaining escrow balances, ensuring projects can either be completed or quickly liquidated while minimizing litigation duration and cost.

Essential Due Diligence Checklist for Off-Plan Investors

Before committing to any off-plan investment in Dubai, verify these critical elements to leverage the full protection of the regulatory framework:

Developer Verification: Confirm the developer holds valid, active RERA licensing and check their compliance history.

Project Registration: Verify the project’s specific DLD approval number (M-code) and confirm registration status.

Escrow Account Confirmation: Request written confirmation of the project-specific escrow account with a DLD-approved bank and verify all payments will flow directly to this account.

Oqood Registration Timeline: Establish clear timelines for Oqood registration following initial payment and confirm registration completion before subsequent payments.

Contract Review: Ensure the Sale and Purchase Agreement includes clear completion dates, payment schedules tied to construction milestones, specification details, and dispute resolution procedures.

Construction Progress Verification: Regularly verify construction progress aligns with approved schedules and milestone-based payment releases.

Why Dubai’s System Stands Out Globally

Dubai’s off-plan protection framework represents a fundamental shift from retrospective punishment to proactive risk mitigation through financial engineering.

The escrow system’s milestone-based fund release ties investor capital directly to verified physical progress, while standardized retention caps and compensation rates provide predictable outcomes.

The specialized tribunal structure ensures that even complete project failures can be resolved efficiently through centralized judicial oversight capable of swift project restructuring or liquidation orders.

For international and institutional investors, this comprehensive regulatory ecosystem offers unprecedented transparency and protection in emerging market real estate investment, provided all verification steps are diligently completed before capital commitment.

Conclusion

Understanding RERA regulations and Dubai’s comprehensive buyer protection framework is essential for any off-plan property investment.

The interconnected system of escrow accounts, mandatory registration, standardized termination procedures, and specialized dispute resolution creates multiple layers of protection against developer misconduct and project failure.

By confirming developer licensing, verifying project registration, ensuring Oqood registration, and understanding your statutory rights regarding delays, specification changes, and potential termination scenarios, you can confidently navigate Dubai’s off-plan market while maximizing the protection afforded by this robust regulatory structure.

The key to successful off-plan investment in Dubai lies not just in selecting the right property or developer, but in thoroughly understanding and leveraging the legal protections that RERA and the DLD have established to safeguard your investment at every stage of the development process.